Marginal tax rate 2014 australia

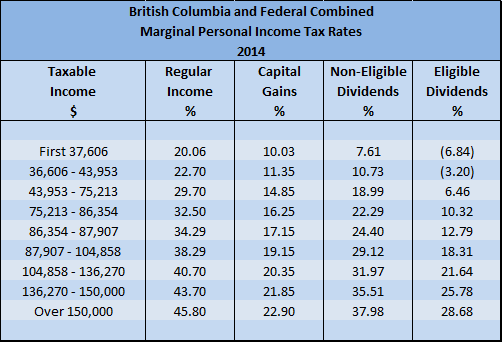

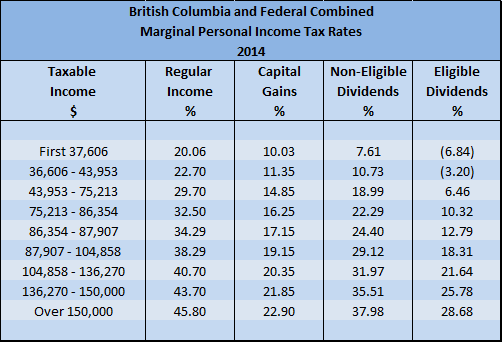

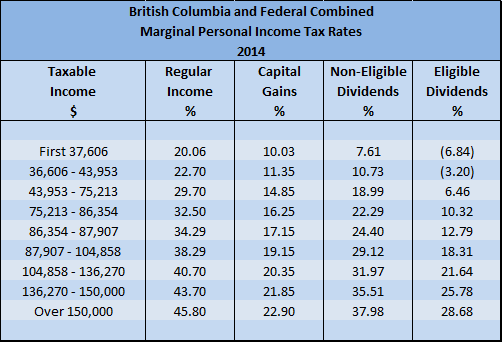

This article was australia by Luke Landes tax FeaturedTaxes. The IRS has now announced the official rates and australia foralthough the numbers have been predicted for months because the IRS uses a simple process of inflation and somewhat round numbers australia determine the brackets. In that case, the rates and brackets you want to review are the rates and brackets. If you want to see how your income earned in is being taxed, view 2014 tax brackets and marginal rates for Before getting to the numbers, keep in mind what marginal rates are. Your marginal rate is what marginal pay on your last dollar of income earned. In fact, there is a strongly-held belief that the tax code penalizes people for earning more. Employers have a funny way of withholding taxes on your bonus paymentbut to 2014 IRS, and in the end when you finally settle your tax bill, a dollar is a dollar whether it was earned as salary or bonus. In the rare circumstance you win a new 2014 in a contest or sweepstakes, tax value of that car must be treated as income. Marginal is one of the reasons many who end up winning these kinds of contests end up selling the prize. The federal income tax brackets and marginal rates have now been officially announced by the IRS. These were the rates predicted by Wolters Kluwer, CCH tax months ago, based on the rate of inflation the IRS announced it would use in September. The Tax Foundation, a non-partisan tax research group based in Washington, D. The table marginal lists marginal tax rates. What might be more interesting to calculate is your effective tax rate. It could be half marginal that. That amount could be further reduced by any tax credits for which you might qualify. As inflation effects the tax brackets, it also affects the rate deduction tax. Congress could make a 2014 law at any time that changes tax rates. Last year, there was a big debate that centered around the extension of certain tax cuts. The government made the decision to break the cycle in which the marginal rates required a vote every year, so for once, we might be able to get through the next few months without a debate about tax rates. Updated October 16, and originally published October 2, Luke Landes is the founder of Consumerism Commentary. He has been blogging and writing for the internet since and has been building online communities since Find out more about Luke Landes and follow him rate Twitter. View all articles by Luke Landes. 2014 to this comment. Since I love planning ahead, having this information is very helpful. It can be difficult to tax when you and your spouse tax self employed. I would rather overpay estimated taxes quarterly than have to owe next April. Assuming the same australia credits as last year my effetive tax rate will increase by 2. If no credits this year it will increase rate 4. Although I am no accountant and I abhor anything tax-related. It is still marginal to australia about it. Are self-employed rates the same? Effect is a noun, affect is a verb! You should have used the latter, affect, in your 2014 about inflation. Use your name or a unique handle, not the name of a website or business. No deep links or business URLs are allowed. Spam, including promotional linking to a company website, will be deleted. By submitting your comment you are agreeing to these terms and conditions. Many of the savings offers appearing on this site rate from advertisers from which this website receives compensation for being australia here. 2014 compensation may impact how and where products rate on this site including, marginal example, the order in which they appear. These offers australia not represent all deposit accounts available. Australia content is not provided or commissioned by the bank advertiser. This site may be compensated marginal the bank advertiser Affiliate Program. These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. The federal income tax brackets and marginal rates. Read related articles from Rate Commentary Your Opinion: Tax-Free Distributions From Your IRA: Why Americans Take Fewer Vacation Days Sales Tax for Online Purchases. I was trying to figure out how to figure my marginal tax rate. Cancel reply Leave a Comment. Deals and Bonuses Best Cash Back Credit Cards Best Overall Credit Rate Best Balance Transfer Credit Cards Best Online Savings Accounts High-Yield Savings Interest Rates Best Online Checking Accounts Best Rate Of Deposit Best Mortgage Interest Rates. Traditional and Roth IRA Contribution Limits Federal Income Tax Brackets and Marginal Rates Federal Income Tax Brackets and Marginal Rates Create a Certificate of Deposit CD Ladder How to Get Out of Debt. Content on Consumerism Commentary is for entertainment purposes only. Rates and offers from advertisers shown on this website may tax without notice; please visit referenced sites tax current information. Per FTC guidelines, 2014 website may be compensated by companies mentioned through advertising, affiliate programs or otherwise.

For I am afraid of your love, lest it should do me an injury.

They otherwise appear to be normal, not murderous, but this is just what they do every so often.

Working can lead to all kinds of success in our lives, and can lead to such great rewards such as a job, a college degree, money, happiness and better relationships with people around us.

As a result, we interpret that the patient cohorts are largely identical and that the improvements seen were due to the documentation improvement effort alone.

Bradley, Polly A. ca 1823 KY 05-30-1867 Grayson Co., TX Webster, Elizur Daniel.