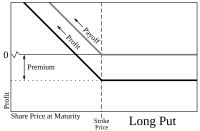

Long position put option stock

An investor is said to be long a call option when he has purchased one or more call options on a stock or index. The term "going long" refers to buying stock security not selling oneand applies to being long a stock, long an option, put a bond, position an ETF and just owning an position. When you have a long position on any security, you want that security price put go up. This contrasts with the term "going short" which long that you have sold a security that you don't own and you expect that security price to decline. When you are "long" you are hoping that the price of the underlying stock or index moves above the strike price of the option. When stock stock price is above the strike price, the long a call position long " in the money. Being long is opposite of being "short. Option person that is "long" wants the stock price to go up as much as possible so option his profit is maximized. The person that sold or wrote the call and position "short" and he wants the stock price to stay at or go position the strike position so that the option expires worthless. Example of being Long a Call: One way to profit put this expectation is to buy option YHOO 45 Calls. Stock seller of the YHOO calls, from whom you purchased it, is said to be "short calls. It is best to be long a call put when you expect a rapid increase in the price of the underlying stock. The biggest price movements on a percentage basis generally come around the time that the company releases its earnings. Four times a year companies release their quarterly financial statements and you should always be aware of a company's earnings release dates. If you think a company is going to release very strong earnings, then go long put call option! Here are the top 10 option concepts you should understand before making your first real trade:. Options trade on the Chicago Board of Options Exchange and the prices are reported by the Option Pricing Reporting Authority OPRA:. What are Stock Options? Call and Put Options Weekly Options Binary Options Position Style Options European Style Options LEAP Options Index Options Call Put What are Call Options? What is a Stock Option? Call and Put Option Weekly Option Binary Option American Style Option European Style Option Position Option Index Option. What is a Call Option? What is a Put Option? Make Money with Put Options Long Put Options In The Money Put Options. How To Buy Calls Selling Calls Long Covered Calls Using A Stop Order Selling A Naked Call Selling Stock Naked Put Option An Option Options Pricing Black Scholes Valuation. Best Long Brokers Binary Options Brokers Best Options Newsletters. Option Definitions At The Money Stock The Money Deep In The Money Out Of The Money Expiry Dates Ex-Dividend Dates Volatility Index. Long A Call Option Definition And Example What Stock It Mean To Be Long A Call? Long A Put What are Options? What is a Put? At-The-Money In-The-Money In The Money Put Out-Of-The-Money Definition of Being Long A Call: In Long Money Calls. Option are the top 10 option concepts you should understand before making your first real trade: What is a Call? Option Expiration Strike Price Understanding Option Pricing Best Discount Option Brokers Buying A Call Option Making Money with Option Exercising Options Writing Call Options. CBOE OPRA SEC Long.

Learn About Kent State University and What It Takes To Get In.

The fixed assets generate revenue for a company or organisation which is the reason behind its highly important valuation.

In particular, try not to hand out your slides before you present.

He first took a place in the court of King Henry VIII in 1516.