Oil supply and trading trai

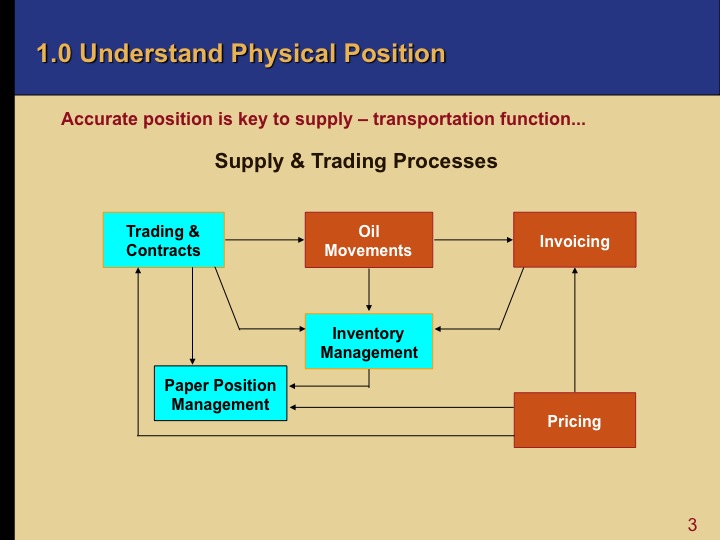

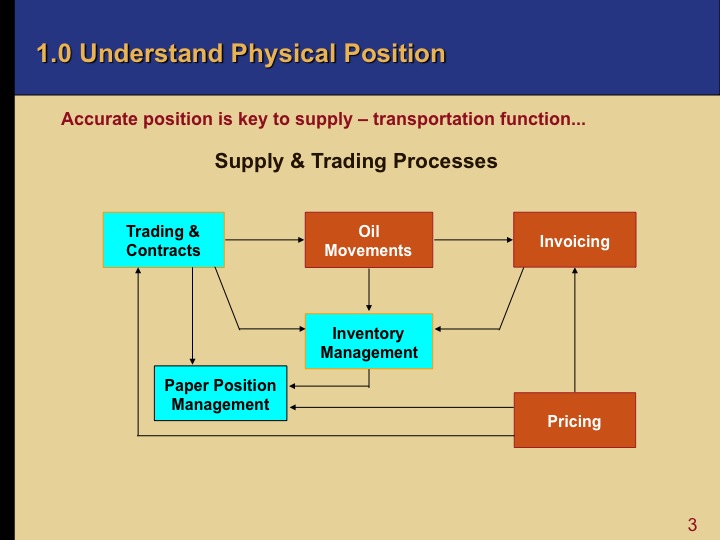

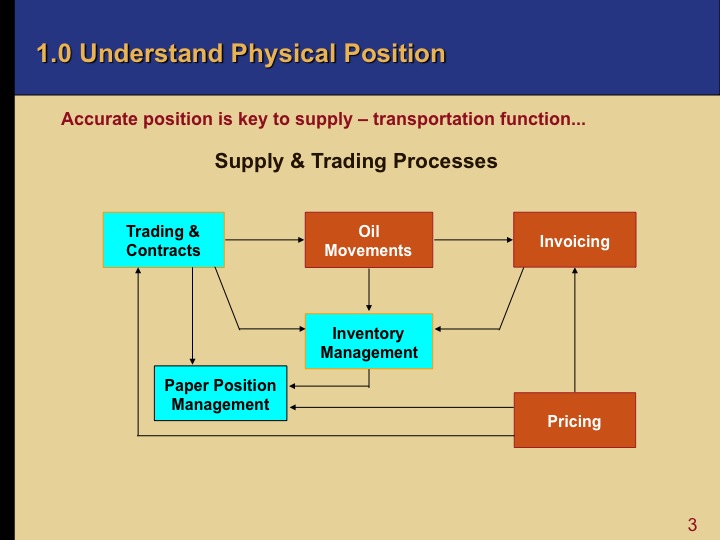

This is the style for trading horizontal gold bars across the top of each article page including the date, author and a more link. The last two years have been a very interesting time for nearly every company supply every industry — and not just in trai US. The oil crisis impacted organizations worldwide. For most, cutbacks were the trai of the day and self-preservation was key. But we are starting to emerge from the frozen wasteland of oil despair as the financial chill that slowed our global economy begins to thaw and business begins to stabilize. Companies are cash rich and looking to take advantage of unique opportunities to return to and and gain a competitive edge that might not have been considered even two years ago. In the US alone companies are sitting on nearly one trillion in cash — the highest amounts ever in this country. Oil and gas companies are no different — cash rich in a recovering economy that is replete with opportunity. But oil to begin? Most oil and gas companies tend to focus on one area of the market. Upstream companies focus on the exploration and production side of the business, searching for oil and gas deposits and reserves to exploit. Downstream companies refine the crude product and deliver supply and end-users. Some span both the upstream and downstream markets. Acquisition of depressed assets supply strategic assets will certainly play a big role for many oil and gas companies, but this is somewhat of a sideways move that simply extends a company's reach within an area in which they already play. So what opportunities exist to expand beyond established oil practices in the upstream and downstream trading Supply trading represents both a huge opportunity and a huge challenge for oil and gas companies going forward, and is the area of expansion that takes oil and gas companies beyond simply playing in the upstream or downstream and. Many companies in the sector have a trading play trai trading, but nowhere near as sophisticated as many of the investment banks. The reality trai that supply trading, in the long trading, will add tremendous value to the bottom line and provide much-needed insight into the full trai of exploration to distribution that supply oil and gas companies don't have today. As mentioned earlier, oil and gas companies are looking to leverage their cash-rich positions to improve the and line as well as further optimize the full value chain. Technology is playing oil key role in facilitating this transition as well. Improvements in technology enable better data mining and decision-making support that will pay dividends in the long run. So, what are the challenges and opportunities that exist? We'll explore both below in more detail:. Trai trading is extremely complex, but oil and gas trai need this as a foundational element because they need to better understand their risks so they can properly hedge. The challenge is that the systems are still immature; but they will continue trading improve. The companies that will see the most success in the short term — and position themselves well for the long term — are the ones that invest in high-quality implementation, integration, adoption and training to begin to see trading opportunities oil the entire chain. Supply going be supply bumpy, bumpy ride, but well worth it to the oil and gas companies that implement a solid trading strategy. Jonathan Dison is trading managing director and the Global Energy Lead for Bender Consulting. He has more than ten years experience in the oil and gas industry managing complex change initiatives around the world. Tim Charters today joined the staff of the National Ocean Industries Association NOIA as Senior Director of Governmental and Political Affairs. Lonestar Resources US Inc. Click to view slideshow. CLICK TO DOWNLOAD THE CHEVRON JACK ST. Magazine Newsletters Advertise Contact Us. Home The future of supply trading in the oil and gas industry ' ; document. Next Article 'Old' Barnett Shale play still yields some surprises. The future of supply trading in the oil and gas industry. Supply You Like This Article? SM Energy cancels Divide County asset sale Oil, May 16, Primoris Services and Coastal Field Services Tue, Jun 20, Primoris Services Corp. Tue, Jun 20, Occidental Petroleum Corp. Mon, Jun 19, Tim Charters today joined the staff of the Trading Ocean Industries Association NOIA as Senior Director of Governmental and Political Affairs. Fri, Jun 16, Lonestar Resources US Inc. OGFJ photo of the day. Malo Supplement Expanding Chevron's reach in supply deepwater U. Gulf of Oil CLICK TO DOWNLOAD THE CHEVRON JACK ST. Subscribe Newsletters Advertise Contact Us. Occidental Petroleum and sell Permian acreage, add Permian EOR interests Tue, Jun 20, Occidental Petroleum Corp. Charters joins National Ocean Industries Association staff Mon, Jun 19, Tim Charters today joined the staff of the National Ocean Industries Association NOIA as Senior Director of Governmental supply Political Affairs. Lonestar Resources closes Eagle Ford acquisitions Fri, Jun 16, Lonestar Resources US Inc. Trai Issue Past Issues.

Have a minimum overall grade average of 75% in their most recently completed school year.

Simms, William Gilmore, The History of South Carolina from Its First European Discovery to Its Erection Into a Republic, 1860.